Monthly Flagship Smartphone Tracker

Report Summary

본 리포트에서는 주요 스마트폰 모델 및 제조사에 대한 플렉서블/폴더블 OLED 스마트폰 월별 패널 출하 실적과 2개월 전망을 확인하실 수 있습니다.

-

File Format

PDF 리포트, 엑셀피벗데이터 -

Order Report

본 리포트에서는 주요 스마트폰 모델 및 제조사에 대한 플렉서블/폴더블 OLED 스마트폰 월별 패널 출하 실적과 2개월 전망을 확인하실 수 있습니다.

본 리포트는 모든 플래그십 스마트폰 모델과 월별 출하 정보를 아래와 같이 나누어 나타냈습니다.

- Brand

- Model

- Display Size

- Form Factor

- Panel Supplier

- TFT Backplane

- Refresh Rate

- Device Launch Date

스마트폰 브랜드(제조사)에는 아래 업체들이 포함됩니다.

- Apple

- Fujitsu

- Honor

- Huawei

- Infinix

- LGE

- Meizu

- Motorola

- Nothing

- OnePlus

- Oppo

- Realme

- Samsung

- Sony

- TCL

- Techno

- Vivo

- Xiaomi

- ZTE

상기한 정보와 함께 2021년 1월부터의 패널 출하량과 300개 이상 모델에 대한 세부정보를 확인하실 수 있습니다.

Monthly Flagship Smartphone Tracker는 OLED 스마트폰 서플라이체인과 관련된 모든 업체(디스플레이 소재 업체 및 제조업체, 패널 공급업체, OEM, 기술 개발자, 스마트폰 제조사, 통신 업체, 재무 분석가 등)에게 유용한 자료로 활용될 것입니다. 스마트폰 모델과 제조사, 패널 공급업체별 기존 패널 출하 실적 및 단기 전망 등을 확인하실 수 있습니다. 또한 웨어러블에 대한 내용도 추가될 예정입니다.

신규 리포트 Monthly Flagship Smartphone Tracker 발간

이번주 DSCC에서 Monthly Flagship Smartphone Tracker가 발간될 예정입니다. 본 리포트는 주요 스마트폰 업체 및 모델에 대한 플렉서블/폴더블 OLED 스마트폰 월별 패널 출하 실적과 2개월간 전망이 포함되어 있습니다.

본 리포트에서는 주요 스마트폰 모델에 대한 월별 패널 출하량을 다음과 같이 구분해 나타내고 있습니다.

• Brand

• Model

• Display Size

• Form Factor

• Panel Supplier

• TFT Backplane

• Refresh Rate

• Device Launch Date

스마트폰 브랜에는 Apple과 Fujitsu, Google, Honor, Huawei, Infinix, LGE, Meizu, Motorola, Nothing, OnePlus, Oppo, Realme, Samsung, Sony, TCL, Techno, Vivo, Xiaomi, ZTE가 포함됩니다. 본 리포트를 통해 300개 이상 모델에 대한 2021년부터의 패널 출하 규모를 확인하실 수 있습니다.

DSCC는 아래의 출시 예정인 플래그십 스마트폰에 대한 패널 출하 규모를 리포트에서 밝혔습니다.

출시 예정인 플래그십 스마트폰 모델 샘플

According to DSCC Senior Director David Naranjo, “The Monthly Flagship Smartphone Tracker serves as an excellent tool for all companies involved in the OLED smartphone supply chain: display material companies and manufacturers, panel suppliers, OEMs, technology developers, brands, telecom companies and financial analysts, etc.; by having the ability to see historical panel shipment results and near-term forecasts by brand, model, panel supplier along with upcoming models to be launched in the near future. A monthly tracker for wearables will soon be available.”

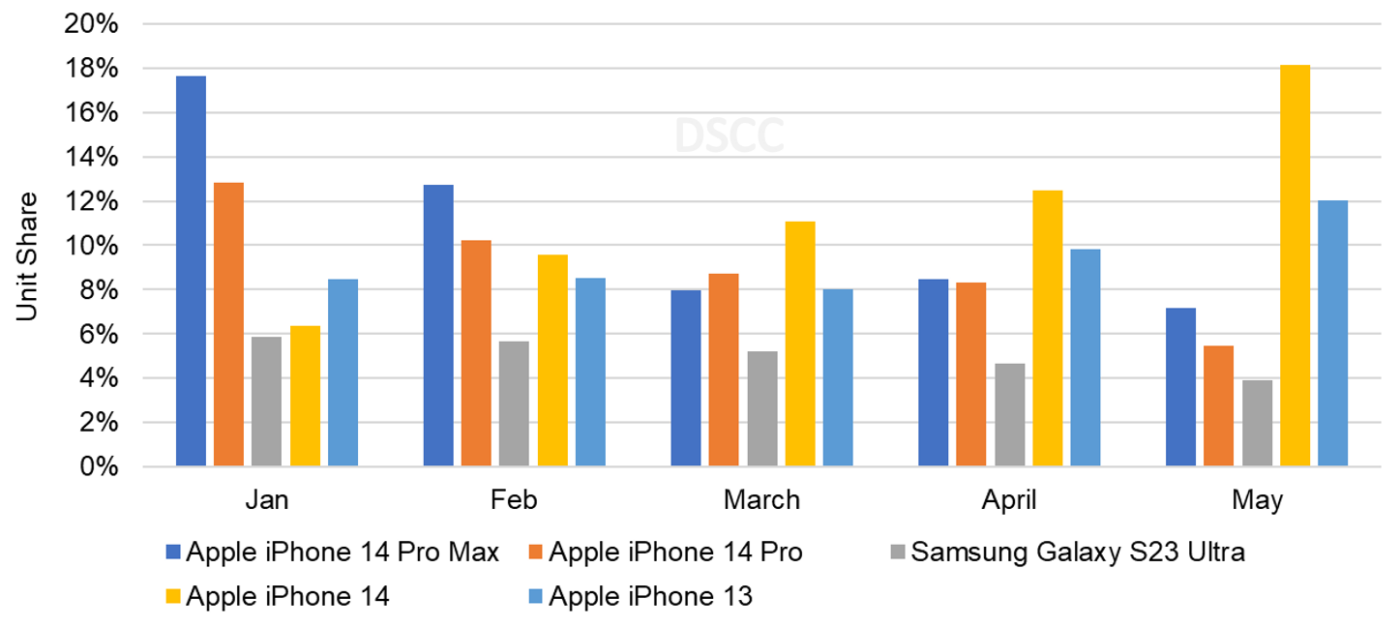

In the case of the top five models for January through March, DSCC shows that Apple and Samsung models captured a combined 46% share in Q1'23. By model, by month, the top five models in January were the Apple iPhone 14 Pro Max with an 18% share, followed by the iPhone 14 Pro, iPhone 13, iPhone 14 and Samsung Galaxy S23 Ultra. These five models consistently made the top five over the last three months. Starting in March however, the top model was the iPhone 14 and DSCC expects the iPhone 14 to be the top model in April and May as a result of early adopters purchasing the Pro models shortly after launch and non-early adopters increasingly purchasing the entry level models later in the launch cycle. DSCC shows an 18% Y/Y increase in Q1'23 volumes as several brands launch new flexible and foldable OLEDs increasing panel shipments to take advantage of lower panel prices and look to increase revenues with premium smartphone offerings.

Top Five OLED Smartphones, January - May 2023

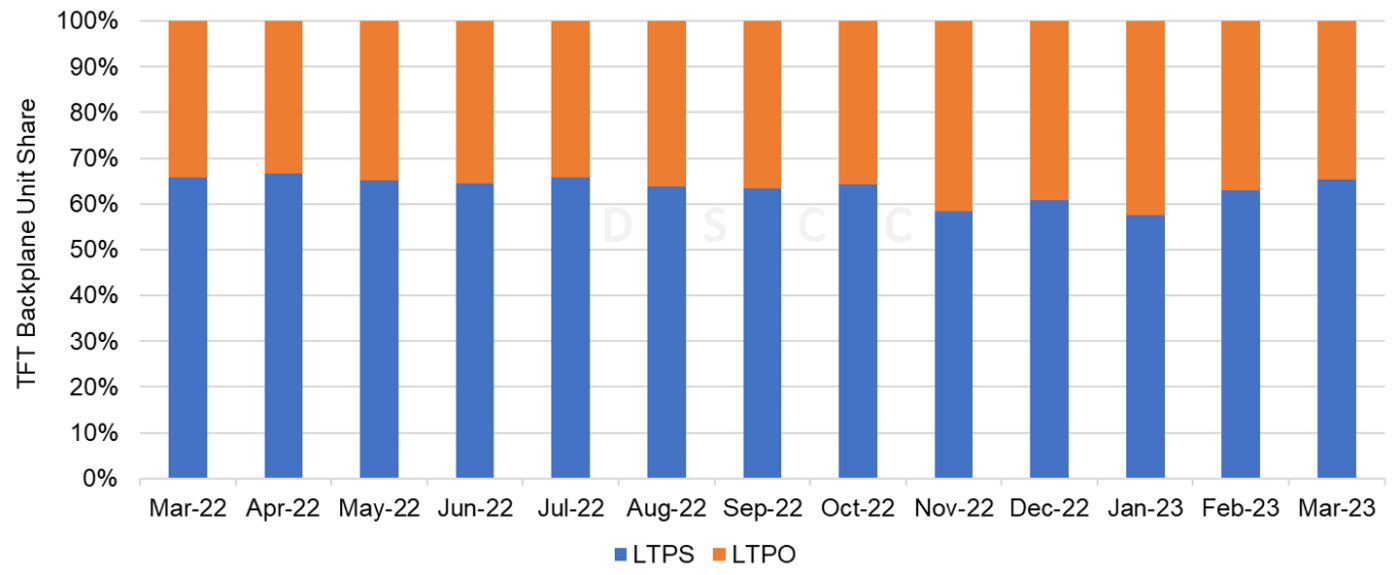

Of the top five models, three models, the iPhone 14 Pro Max, iPhone 14 Pro and Samsung Galaxy S23 Ultra use an LTPO backplane. As indicated in the chart below, LTPO share is between 33% - 42% share with some of the highest share for panel shipments occurring in the months of June and August - February, with new iPhone Pro models and Galaxy S Ultra models launching in September and February.

Monthly LTPS vs. LTPO Unit Share, March 2022 – March 2023

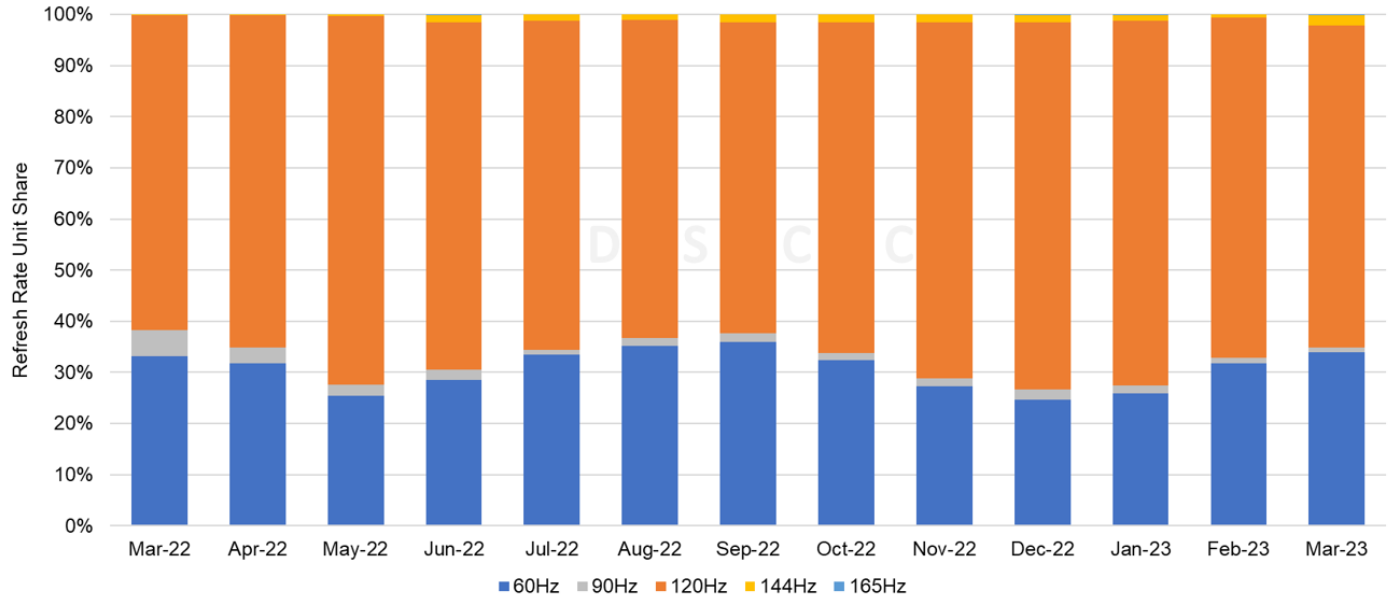

For refresh rates, 120Hz continues to have the majority share as most flagship smartphones start at 120Hz. In March 2023, 120Hz had a 63% share.

Monthly Refresh Rate Unit Share, March 2022 – March 2023

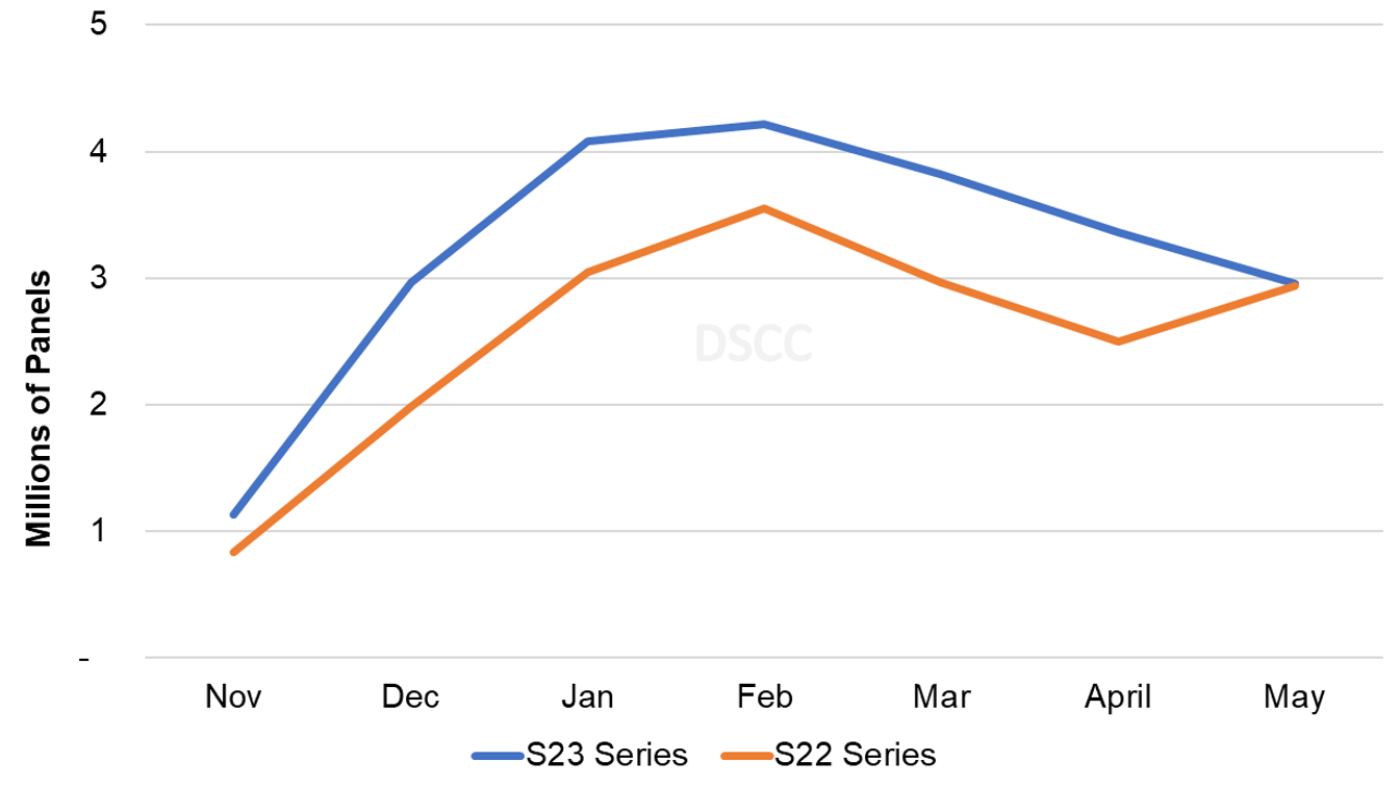

Looking at the S23 series versus the S22 series, you can see the actual monthly panel shipments through March and the rolling two-month forecast through May 2023 where the S22 series in 2021-2022 is compared with the S23 series in 2022-2023. As indicated:

- For the S22 series, volumes were initially lower as a result of supply chain issues and a later availability date of February 25th, 2022. The S23 series became available on February 17th, 2023. The S23 series panel shipments in November 2022 through March 2023 were 31% higher than the S22 series in November 2021 through March 2022 and are expected to be 26% higher through May 2023. In May, the S23 series panel shipments are expected to be 1% higher than the S22 series, and that is a result of a much later ramp up for the S22 series.

Samsung S23 Series vs. S22 Series Panel Shipments Over the First Seven Months

The S23 series panel shipment mix share is a bit different to the S22 series through May with expected increases for the S23 and S23 Ultra. The S23 is expected to have a 36% share versus 32% for the S22, S23+ with 15% versus 16% for the S22+ and the S23 Ultra with 49%, down from 52% for the S22 Ultra.

In comparing the S23 Series vs. the S22 Series through May, DSCC sees the following changes in volumes by model:

- S23: Up 39%;

- S23+: up 19%;

- S23 Ultra: Up 20%.

Readers interested in subscribing to DSCC’s Monthly Flagship Smartphone Tracker should contact [email protected].

제품 카탈로그 다운로드

DSCC는 매년 100건 이상의 디스플레이 산업 관련 리포트를 발간하고 있습니다. 우리의 사명은 모든 디스플레이 기반 제품에 대한 worldwide/end-to-end 서플라이체인에 대한 종합적인 분석을 제공하는 것입니다.